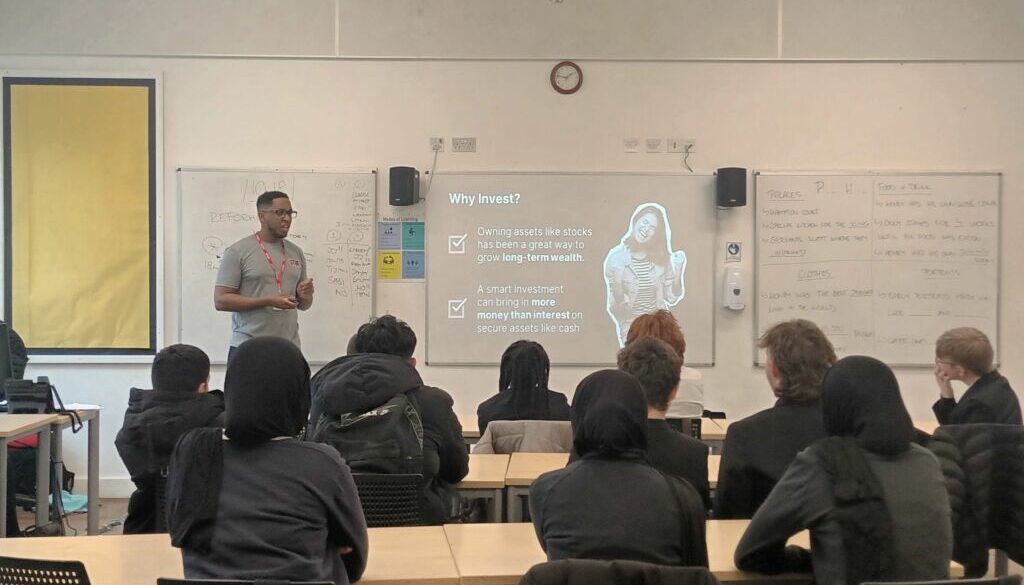

Developing Good Money Habits with The Set Them Up Foundation

Knowing how to handle your money is of utmost importance for the future and learning how to develop good money habits earlier on in life can save you a lot of hardship in the long run – which is exactly why this month we had The Set Them Up Foundation (STUF) visit Year 10s and 11s at City Academy Bristol and Oasis Academy Brightstowe to make financial literacy fun.

The money masterclass taught us everything – from what mistakes to avoid, such as building up credit card debts for a trip to Ibiza or that brand new tracksuit, as well as how to how to pinch, save and invest those pennies to make them go further.

Students began by learning about what inflation is – a word that we hear bounced around a lot but may not always understand the impact or relevance of. Following this we delved into why budgeting is important and how we can do it efficiently using the 50-30-20 rule (50% for needs, 30% for wants, 20% for savings). STUF then discussed with pupils some mistakes that a lot of us are guilty of making, such as keeping a monthly subscription that never gets used – whether that’s a gym membership, or being signed up to Netflix, NowTV, Amazon Prime AND Disney Plus.

Next up it was on to saving money where students learnt the importance of saving money and how this can help us prepare for emergencies. It can be hard to know where to start with saving, which is why STUF covered the different realistic methods you can use such as opening a savings account, using round-up apps, or starting off small with the 1p challenge and building up gradually from there.

After this students got a beginners guide to investment (top tip: don’t listen to investment ‘experts’ on TikTok) and learnt how and when to invest – and the importance of only investing money when you are in a secure financial place with savings ready to cover any potential losses and not to fall into the temptation of trying to win quick and win big. Finally, STUF covered the differences between debit and credit cards, how your credit score can be impacted by not keeping up payments, and what to do if you do find yourself in a rut in with debt building up.

To finish, STUF put students through their paces with a quiz about what they had just learned (with prizes of vouchers up for grabs!) and we were impressed at how many hands shot up knowing the answers! Students expressed that they found this workshop really useful, especially for learning how to save their money in the future and they left feeling more confident about how to develop and maintain good money habits. A massive thank you to The Set Them Up Foundation for travelling from London to spread their financial wisdom with this fun, interactive and relatable session!